Understanding historical trends in the nylon value chain prices is crucial for stakeholders in the textile, automotive, and packaging industries. Fluctuations in nylon prices can significantly impact production costs, supply chain dynamics, and market competitiveness. In this article, we delve into the historical trends of nylon value chain prices, examining key factors influencing price movements and strategies for navigating these fluctuations effectively.

1. Understanding Nylon Value Chain Dynamics:

Raw Material Prices:

The price of nylon is closely tied to the cost of raw materials, primarily caprolactam and adipic acid. Fluctuations in the prices of these key inputs, influenced by factors such as crude oil prices, feedstock availability, and demand-supply dynamics, directly impact nylon prices.

Manufacturing Costs:

Manufacturing processes, energy costs, labor wages, and technological advancements play a significant role in determining nylon production costs. Efficiency improvements and innovations in manufacturing technologies can help mitigate cost pressures and maintain competitiveness.

2. Factors Influencing Price Movements:

Global Economic Trends:

Macroeconomic factors such as GDP growth, inflation rates, and currency fluctuations influence demand for nylon products across industries. Economic downturns may lead to reduced demand for nylon, putting downward pressure on prices, while periods of economic growth may drive increased demand and price appreciation.

Industry Demand-Supply Dynamics:

The textile, automotive, and packaging industries are major consumers of nylon products. Fluctuations in industry demand, driven by factors such as consumer preferences, regulatory changes, and technological advancements, can impact nylon prices.

3. Historical Price Trends:

Price Volatility:

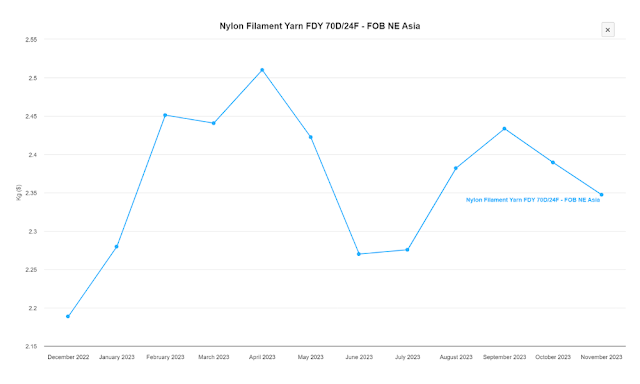

Historical data reveals periods of price volatility in the nylon value chain, driven by geopolitical events, natural disasters, and shifts in global trade dynamics. Understanding past price trends helps stakeholders anticipate future market movements and implement proactive strategies.

Long-Term Price Trends:

Despite short-term fluctuations, long-term trends in nylon prices exhibit gradual growth due to increasing demand from various end-use industries and limited capacity expansions in the nylon value chain. Analyzing historical data enables stakeholders to identify underlying market trends and make informed decisions.

4. Strategies for Navigating Price Fluctuations:

Diversification of Suppliers:

Maintaining relationships with multiple suppliers diversifies supply chain risk and provides flexibility in sourcing raw materials. Negotiating long-term contracts and implementing risk management strategies can help mitigate price volatility.

Inventory Management:

Striking a balance between inventory levels and production schedules is essential for managing price fluctuations. Maintaining adequate buffer stocks during periods of price stability can safeguard against supply disruptions and price spikes.

Understanding the historical trends in nylon prices is like charting the course of a dynamic market voyage; armed with insights from the past, businesses can navigate the waves of price fluctuations and steer towards smoother sailing in the future.

Conclusion:

Navigating historical trends in the nylon value chain prices requires a comprehensive understanding of market dynamics, economic trends, and industry drivers. By analyzing historical data, identifying key factors influencing price movements, and implementing proactive strategies such as supplier diversification and inventory management, stakeholders can mitigate risks, optimize costs, and maintain competitiveness in the dynamic nylon market. With careful planning and informed decision-making, businesses can navigate price fluctuations effectively and capitalize on opportunities for growth in the nylon value chain.

FAQs on Historical Trends in Nylon Value Chain Prices:

1. What factors contribute to fluctuations in nylon prices?

- Fluctuations in nylon prices are influenced by factors such as raw material costs, manufacturing expenses, global economic trends, and industry demand-supply dynamics.

2. How do raw material prices impact nylon prices?

- Raw materials like caprolactam and adipic acid significantly influence nylon prices. Changes in the prices of these inputs, driven by factors like crude oil prices and supply-demand dynamics, directly affect nylon production costs.

3. What are some historical trends observed in nylon prices?

- Historical data reveals periods of price volatility in the nylon value chain, often influenced by geopolitical events, economic trends, and industry developments. Long-term trends typically show gradual growth due to increasing demand and limited capacity expansions.

4. How can businesses navigate price fluctuations in the nylon value chain effectively?

- Businesses can navigate price fluctuations by diversifying suppliers, implementing inventory management strategies, analyzing historical trends, and staying informed about market dynamics to make proactive decisions.

5. What role do economic factors play in nylon price movements?

- Macroeconomic factors such as GDP growth, inflation rates, and currency fluctuations influence nylon demand and prices. Economic downturns may lead to reduced demand and lower prices, while periods of growth can drive increased demand and price appreciation.

6. How can stakeholders anticipate future market movements in the nylon value chain?

- Analyzing historical data, monitoring raw material prices and industry trends, and staying informed about macroeconomic factors can help stakeholders anticipate future market movements and make informed decisions about pricing and supply chain management.

7. What are some strategies for mitigating risks associated with nylon price fluctuations?

- Strategies for mitigating risks include diversifying suppliers, maintaining buffer stocks, negotiating long-term contracts, and implementing risk management strategies to safeguard against supply disruptions and price volatility.